SMART Communication Tools – Are They the Answer to BFSI Enterprises’ Many Challenges?

Our increasingly digitized world has created fresh challenges for banks — falling revenues, emergence of third-party services, high churn rates, and increasingly demanding customers. Somehow, all of it is tied, in one way or the other, to customer experience. Banks know that to remain competitive, they must urgently invest in digital technologies that will help them reach out to more customers and serve them with speed and precision — making banking a frictionless, even enjoyable experience for them. But they also realize that strengthening of customer relationships needs to go hand in hand with lowering costs. And they are increasingly turning to advanced communication technologies to attain this.

Communication platforms are turning out to be a real boon for businesses, helping them overcome many bottlenecks and improving their overall profitability. This pager discuses six major ways in which advanced communication platforms can help BFSI enterprises rise above their challenges.

1) Reduce Costs by Complementing SMS Services With Cheaper OTT Messaging Tools

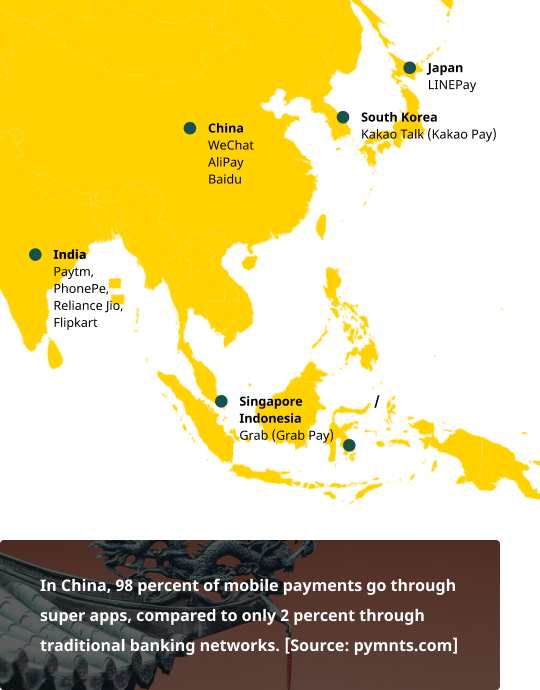

Messaging has truly emerged as one of the foremost ways for BFSI companies to build dynamic and personalized relationships with their customers. While SMS has been the backbone of messaging for most enterprises, over the years OTT apps such as WhatsApp, Kakao Talk, LINE, and WeChat have gained importance as customer engagement tools due to their clear cost benefits.

The average price per SMS varies widely according to countries. Typically, OTT messaging platforms are significantly cheaper compared to traditional SMSs in developing markets. For example, the cost of sending an SMS in Brazil is 55 times higher than doing the same in the US. Markets such as Spain, South Korea, and the Netherlands have a high per-message cost for SMS and fail to offer unlimited SMS packages at affordable prices. This drives many BFSI players to prefer low-cost OTT messaging platforms over SMS in such markets.

Another reason why OTT messaging is preferred is because banks need to have an arrangement with only a single entity to avail the services, whereas for SMS, they need to enter into agreements with multiple telecom operators operating in different regions. Also, with different GSM networks operating around the world, SMS delivery is not always guaranteed, whereas an OTT platform’s single infrastructure ensures higher delivery rates.

Major Benefits of Using WhatsApp Over SMS

- Lesser Text Limitations — WhatsApp allows up to 4096 characters compared to only 160 characters for SMS

- Guaranteed Delivery — For SMS, there are different GSM networks around the world, so delivery is not guaranteed; WhatsApp offers guaranteed delivery provided one has an internet connection

- Rich Media Support — In addition to SMS’s text messaging, WhatsApp enables transfer of audio, videos, attachments, location sharing, and more

- End-to-End Encrypted — WhatsApp is secure and private

- Two-Way Communication — Unlike SMS, WhatsApp supports both inbound and outbound communication

- Facilitates Payments — WhatsApp enables integration with payments capabilities to enable transactions, a key advantage over SMS

- Provides “Read” Receipts — WhatsApp provides status-based read receipts

2) Counter Growing Threats From Super Apps by Offering Similar Convenience Within an Integrated Platform

Super apps, which provide integrated services and payments for all industries in a single chat window, are creating real challenges for traditional banking. Functions that were once the exclusive domain of banks — payments, transfers, lending, investments — are increasingly being performed by super apps. Customers love and trust them for the simplicity, security, and convenience they offer. Banks stand to lose customers, because although most payments within super apps still flow through the traditional banking architecture, these apps end up distancing banks from their customers by playing intermediaries and winning customer loyalty for their own brand.

Already major disruptors in Southeast Asia, super apps need to be taken seriously by global BFSI enterprises that have set sights in these markets. With even tech giants Amazon and Apple foraying into digital payments, how are banks ensuring customer retention?

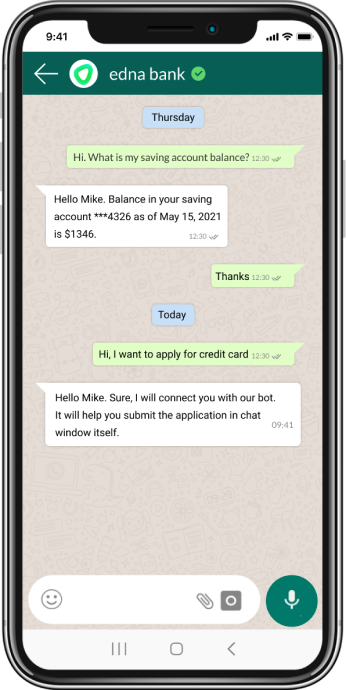

Leading banks are countering this by transforming their ecosystem and offering their entire suite of financial products within integrated digital financial platforms. They are investing in seamless digital tools to integrate with non-banking apps (travel, retail, F&B, healthcare, etc.) that will help them access more customers and reduce customer acquisition costs. Also, just as super apps piggyback on existing smartphone features such as messaging, banks are also channeling already popular communication platform such as WhatsApp to embed themselves in the lives of their customers, which was not possible simply by introducing their own app. These messaging channels are helping BFSI companies offer a wide variety of services and products in a personalized and seamless way to customers.

3) Lower Customer Wait Times by Deflecting Calls to Text Communication Support

The BFSI sector is under immense pressure to optimize customer experience. Customer expectations have grown manifold, especially when it comes to speed and convenience. Customers that call up banks for inquiries are typically put on hold for a long time due to huge call volumes and agent shortages, because an agent can only answer one call at a time. The pandemic has led to even longer wait times, driving down customer satisfaction scores tremendously and leaving BFSIs vulnerable to churn in a world full of options.

Leading BFSI players are getting around this problem by encouraging customers to reach them on text communication channels. They are transferring inbound calls to chat by leveraging IVR deflection, which has the ability to deflect incoming customer calls to WhatsApp chats.

Distinctive Advantages of Chat Support Over Tele-Support

- Quicker query resolution as a single agent can handle multiple queries simultaneously

- Cheaper than calling, for both the BFSI company and its customers

- More efficient query resolution as agents as well as customers have full access to the chat history

- Easier access to other services as agents can simply share links in the chat window

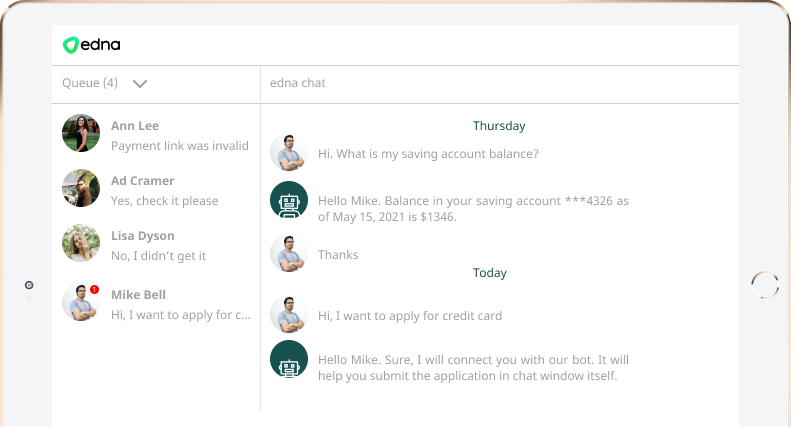

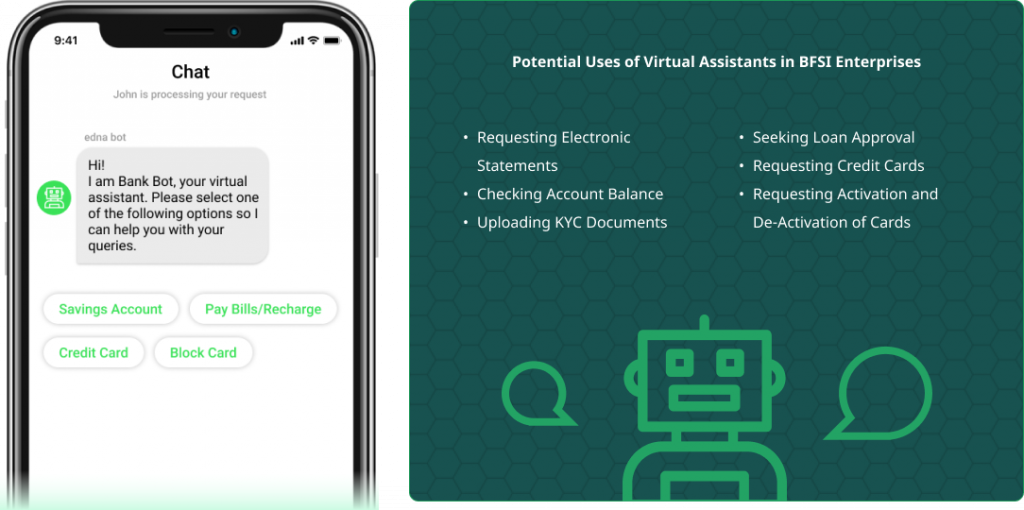

4) Bring Step Changes in Customer Service by Leveraging Automation for Repetitive Queries

BFSI enterprises need to answer queries from thousands of customers daily — and all this in real time. They dedicate whole teams that need to manually read / listen to these queries and route them to concerned departments. However, surveys indicate that at least 80 percent of customer queries are repetitive in nature, and can be easily handled by deploying automation technologies that require little to no human intervention. Which is why BFSI players are increasingly turning to automated message templates for quick replies, chatbots, tags for dialogue markups, and so on. As per Mckinsey’s Global AI Survey report, at least 32 percent of financial institutions use virtual assistants for customer service divisions. Not only has this helped them improve customer service, it has also enabled them to attract more customers and save on costs.

How Automated Communication Helps

- Enables a host of self-service options: In a conversational tone, bots collect basic user information and answer all their specific questions. They guide customers through multi-step processes with ease to fulfill their objectives. Tasks are completed with just a few clicks and no wait times.

- Reduces fraud by verifying customer identity: Through automation, client information can be quickly verified by tallying it with reference data. This eliminates errors in entry and detects and prevents fraudulent attempts.

- Generates automated insights from client data: Automation enables client interaction data to be segmented and tagged in real time as the conversation proceeds. This helps businesses generate valuable insights they can use to target and retarget customers with tailored products.

5) Leverage Omnichannel Strategy to Reduce Message Delivery Failure and Reach Clients on Their Preferred Channel

BFSI enterprises share a variety of messages with their clients daily. Many of these include highly time-sensitive and critical information such as OTPs, transaction notifications, and fraud alerts. It’s vital for businesses to ensure fail-proof deliveries of such messages, preferably over multiple channels for guaranteed delivery. Failure to do so results in loss of reputation and business for companies.

Also, different customer demographics have different channel preferences for receiving different types of communication — for example, customers may prefer to receive payment reminders on SMS, but favor email for consolidated e-statements. It’s critical for BFSI companies to communicate with customers on their favorite channel to increase engagement. For this, they need to get their cross-channel strategy right.

To begin with, BFSI enterprises will need to ensure that they have multiple channels — SMS, email, WhatsApp, push, or Messenger — at their disposal. This will enable them to share communication on the customer’s chosen channel and earn higher engagement from the customer’s side. Also, since it’s impossible to keep track of the channel preferences of millions of clients manually, BFSI enterprises will need to choose communication platforms that have automated channel sequencing orchestration capabilities that can target users on channels which have the best chance of engagement. In case of delivery failure on one channel, they can automatically send the communication over the fall-back channel.

6) Ensure Regulatory Compliance With Trusted Communication Solutions Providers

BFSI companies have access to huge volumes of confidential customer data. Maintaining this data securely is critical — they must comply with stringent regulations and ensure all rules regarding security and privacy are adhered to. Customer data platforms have a unified customer database that has all kinds of information, say for example data on customer preferences, information on a customer’s channel-specific opt-ins, etc. BFSI enterprises need to ensure that all these opt-ins have been legally procured. Also, they need to ensure that all customer communication flowing through the CDP and APIs is end-to-end encrypted, so that the customer feels safe communicating over any channel. To ensure all of the above, they need to engage with solution providers such as edna that strictly comply with GDPR and other such data privacy regulations.

edna is a leading digital communication solutions provider that is revolutionizing the way organizations connect and converse with consumers. For more than 15 years, we have been helping companies to use advanced communication technologies to orchestrate streamlined, programmatic omnichannel communications over all major social messengers, live web and in-app mobile chat, PUSH messaging and SMS. edna is an official service provider for WhatsApp Business, Apple Business Chat, and Viber for Business. We work with 550+ enterprise clients that include leading organizations in Retail, FMCG, Banking, Insurance, Air Travel, Telecom, Hospitality and Healthcare and process 4 Billion+ messages every month. Learn more about our offerings at edna.io

Submit details below to download white paper

Why Read It:

- Learn how banks are leveraging SMART communication platforms to take on super apps

- Discover how these platforms are enabling self-service options and reducing wait times

- Understand their role in delivering time-sensitive, personalized messaging securely

- Find out how these tools are helping to reduce costs