edna Helps Leading Bank Leverage WhatsApp to Send OTPs and Other Vital Business Communication

A leading Indonesia-based bank sought to leverage a digital communication channel to be able to reach customers easily with updates, OTPs, reminder messages, and more.

The Client

PT BPR Hasa Mitra, West Java, came into existence with the acquisition of PT BPR Narwastu Mikro Perkasa by new shareholders in August 2018. It was initially established under the name of PT BPR Bantoru in 1988. The bank has a large network of offices which includes 10 branch offices, 53 sub-branch offices, two cash offices, two payment points, and three mobile cash registers spread across West Java, Banten, and Jakarta. As one of the major players in the Indonesian economy, the bank has a huge responsibility to provide services to the wider community by offering an effective, sharia-compliant banking education to help them develop as a strong national resource.

Challenges

No Digital Means to Share OTPs for Recently Launched Mobile Apps: The bank had just launched its mobile application but needed a solution to share OTPs and other important messages with customers. It lacked a cost-effective and reliable channel to send service messages to its customers digitally. This was a major customer service issue as today’s customers expect banks to share important updates digitally and proactively through secure channels.

Slow Customer Support: The bank lacked a channel that could provide quick customer support to those seeking it. They used WhatsApp to communicate with their clients but it was done manually with a WhatsApp number, and so was inherently time-consuming and inefficient. This clogged up support pipelines and created dissatisfaction among customers, never a good sign in an industry highly susceptible to churn. Also, they did not have a WhatsApp widget on their website, so most of the time clients would not even be aware that they did have a WhatsApp number.

Solution

To set things right, the bank began to explore the option of leveraging a digital channel via which it could send out service messages as well as other official announcements in a quick, secure and cost-effective way. It also wanted to ramp up its customer support capabilities. To achieve these goals, it looked to team up with a solution provider whose solutions could be integrated with its internal systems to support its operational activities. It also wanted a provider that was complying with all applicable regulations and guidelines and guaranteed transparency and fairness in all its products. The bank decided to deploy edna’s WhatsApp Business API solution and chat center.

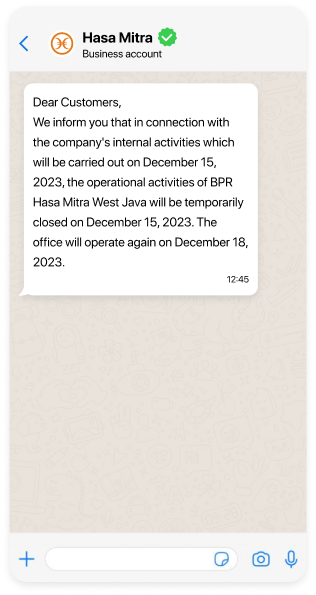

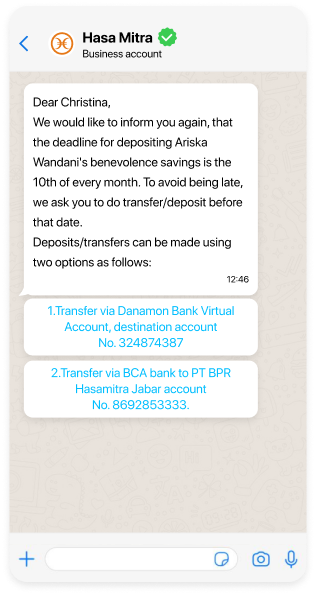

The edna team implemented the WhatsApp and chat center solutions in a quick and hassle-free way. The WhatsApp Business API was up and running soon and the bank began to send out a variety of service and transactional messages via the channel. The channel was used to send OTPs from core banking to clients when they logged in to their mobile apps as per regulation from OJK (Financial Services Authority of Indonesia). The bank also used the WhatsApp Business API to send verification codes, greetings messages, account activation messages, payment invoices, upcoming payment reminders, information on rules regarding funds transfer, announcements about temporary closures of offices, and much more. The WhatsApp Business API was easily integrated with the bank’s existing systems, enabling agents to provide all-round support on the app. More conversations happened with customers on WhatsApp after its implementation.

The bank used edna’s chat center to make customer interactions easier and more streamlined with automation. Using the chat center’s features, they were able to sort and reply to customer messages in a timebound manner. Customer support agents were able to handle multiple queries on chat simultaneously, reducing the time taken to resolve queries and increasing customer satisfaction.

The bank is in plans to implement chatbots in the near future.

Head Of Operational Department

I can confidently attest to the transformative impact of integrating WhatsApp Business API for sending OTPs and service messages. This solution has streamlined our operations and significantly enhanced customer experience. The technical support provided throughout the implementation process was exceptional, ensuring a smooth transition and continued success. We are delighted with the results and highly recommend this solution to any financial institution looking to optimize its messaging strategy’

Results

Using edna’s WhatsApp Business API and chat center solutions benefitted the bank greatly. There was:

- 70 percent increase in customer satisfaction rate

- Up to 91% messages delivered

- 60% of customer conversations happened on WhatsApp post its implementation

- Decreased first resolution time

- Optimized customer support

- Cost reduction for marketing communications