Shifting Gears — How Covid-19 is Accelerating the Auto Industry’s Move to WhatsApp

The covid pandemic has challenged businesses in unthinkable ways, leaving practically no industry untouched. In-store sales have slumped, many have shut down, expansion plans have been derailed, leaving many businesses gasping for breath. This ‘’new normal” has compelled enterprises to rethink their business models and come up with new strategies to cater to a world driven indoors. While industries such as retail and food & beverage have been expanding online for a while now, covid has accelerated their move. Even the auto industry — which has traditionally depended on in-store sales — is quickly realizing the need to build an online presence to be accessible to customers at all times.

Then vs Now

Earlier, potential car buyers would have to resort to newspaper ads, dial customer care, or visit the showroom for pre-sales enquiries. It was normal to be kept waiting on the telephone line for a long time, and going days before receiving a call-back from a customer care executive. Thanks to technology, and now covid, that has changed irrevocably. Now they look up cars online, prefer to message customer support for presale queries and after-sales support, and try to minimize visits to the showroom. Automakers are realizing that having a conversational digital interface that handholds their customers from digital discovery to ownership online is no longer just a fancy addition to their capabilities — it’s a critical need to stay relevant in a changed world. And they are increasingly leveraging digital tools like WhatsApp to achieve this. An April 2020 survey* showed that 61 percent of car buyers are open to online buying after the pandemic, as opposed to 32 percent earlier.

What Makes WhatsApp Business an Indispensable Tool in Improving Customer Service in the Auto Industry

WhatsApp has changed how people interact not just with each other, but with businesses as well. Many automakers initially launched their own apps, but found not many people using them. So they have now made their services available on WhatsApp, which is already being used by billions of people globally. Interested customers can opt-in easily by typing “Hi” on the company’s WhatsApp number to get chatting. Customers and automakers alike have seen major benefits from the messaging platform.

How Customers Benefit

The pandemic is expected to increase the demand for vehicles this year as more people now prefer the safety of their own cars rather than share rides. However, they also want to keep their dealership visits to a minimum to reduce in-person contact. This has precipitated the need for online platforms that can help buyers complete most or all of their journeys online. And buyers are enthusiastically turning to automakers and dealers that have a WhatsApp presence for each stage of a purchase:

- Conduct Pre-Purchase Inquiries: Most potential buyers today look up information on new /used cars on the internet first. Automakers with a WhatsApp Business account can directly suggest the most suitable cars to customers over chat once they submit information such as their city, budget, preferred dealerships, desired models, colors, variants, etc. They can even offer virtual 360-degree views of the models and suggest waiting times for each. Once the customer expresses interest in a model, they can schedule an at-home test drive over WhatsApp. Chatbots on WhatsApp can achieve this without any human intervention.

- Complete Purchases Online: Buyers can discuss financing options with sales assistants on WhatsApp chat, receive personalized deals, confirm bookings, check the status of their loan applications, receive alerts on approved loans, select their preferred insurance partner, and make payments online. They can book appointments for vehicle delivery and also request spare parts and extra accessories over chat. As per a recent survey*, 54 percent car buyers prefer financing online now, as compared to 36 percent before the pandemic.

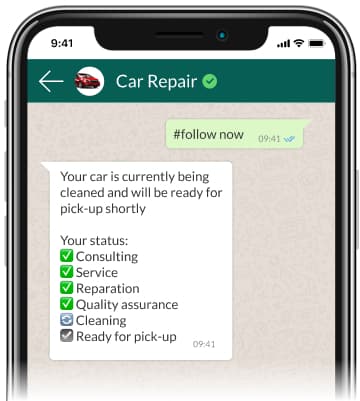

- Get Help With After-Sales Services: In current times, at least 88 percent** dealers are going beyond just conducting business at their physical location. This involves a host of post-sales services. Customers can receive automated alerts about inspection, pending servicing, book slots for servicing, receive real-time updates on the status of their servicing, and make payments for the same on WhatsApp. They can order parts to be replaced online. They can also request immediate breakdown assistance on the app. Premium customers can even request online mechanical consultation.

How Automakers and Car Dealerships Benefit

Automakers should not look at WhatsApp Business APIs as an avoidable cost undertaken simply to delight customers, but as an investment that yields solid returns. Consider how some key automakers have benefitted from messaging apps:

- Send Personalized, Visually Appealing Promotional Campaigns at Scale: Auto brands and car dealerships can use customer preference insights gained through multiple touchpoints to send targeted promotional campaigns customers will actually find helpful. Leveraging WhatsApp’s rich messaging features, brands can share videos, images, etc., about new model launches and send personalized invitations to launch events — all of which help to create a sense of belonging to the brand.

- Process Requests Automatically, Reducing Time-to-Action: Car makers can leverage automation tools built into powerful communication platforms like edna to send automated responses to greetings and common queries, and route more complex questions to human agents. This helps auto companies process thousands of messages easily, significantly reduces call-back requests, and improves the team’s performance.

- Grow Their Customer Database: Automakers can expand their digital reach among both existing and new clients using WhatsApp. When existing customers (who may have bought their cars entirely offline) bring their vehicles for servicing, automakers can ask them to opt-in to receive all servicing-related alerts on WhatsApp. When potential customers walk into a showroom to check out a particular model, they can be encouraged to scan in-store QR code signages to start conversations with the company on WhatsApp. Such measures help automakers grow their brand online.

- Offer Customer Support in More Cost-Effective Ways: WhatsApp enables auto service centres to be uber-responsive to their customers’ needs. It also offers security and privacy to share confidential information in a hassle-free manner. When customers feel supported, they tend to trust such brands and engage with them more. Automakers also realize significant cost savings, as automated chatbots can handle multiple user chats simultaneously, reducing the need to maintain large customer support teams.

- Make Internal Communication More Efficient: WhatsApp Business has enabled car makers to communicate with their employees and dealers in a more efficient manner. Teams working remotely in far-flung workshops and factories are quickly and conveniently reachable over WhatsApp rather than on emails.

Sources:

1. CarGurus Inc.*

2. Cox Automotive Inc.**

![[photo]](https://edna.io/wp-content/themes/edna/images/authors/rajrupa-ghoshal.jpg)

![[icon]](https://edna.io/wp-content/themes/edna/images/authors/ico-linkedin.svg)